Life, with it’s limitless complexity, throws us a curveball once we turn 18. All of a sudden, everyone around us - parents, friends, family, teachers, even strangers - begin to ask us the question, “What do you want to do?” Of course, that question is really asking us what kind of job we want. So, at a young age - with little to no life experience - we are asked to make a life altering decision.

Nowadays, any answer to that question that involves college will be sufficient for most.

How this college came to be widely accepted as an answer to that question is a topic for another day. So, if college is generally thought of as a tool for success, why don’t we take a look at the economic, skill building, and social aspects of it.

We will dive into skill building and economics today. The social pros and cons of college will be weighed soon…so stay tuned.

Economics

College has been a vehicle for success for some. Notably the Boomers who only had to pay an average of $200 - $2,500/year to attend a public university, or $2,000 - $10,000 when inflation is factored in. Those who went to private universities were paying $2,000 - $4,500/year ($16,000 - $35,000/year in today’s money) and, on top of that, the degree they earned often allowed for true opportunity.

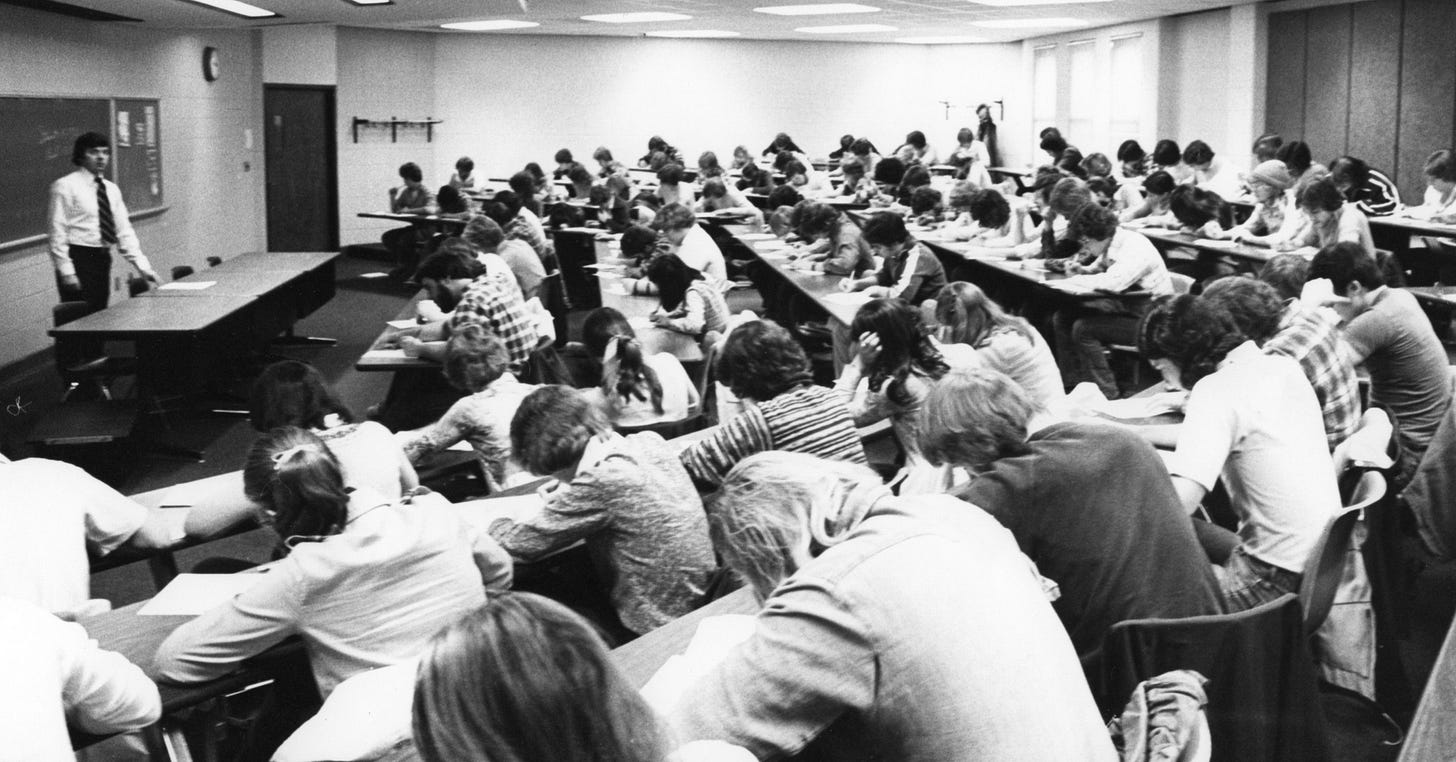

With rapid economic growth after WWII, 60 - 80% of college graduates were able to find jobs closely aligned with their degree between the years of 1960 and 1980.

(Photo from the Walker College of Business, 1970s)

Couple that with the fact that most would only have to work a part-time job to pay for college (in stark contrast to today) and going to college would seem like a perfectly reasonable path to take.

Things have changed…

The modern average cost for a student to go to a public university is $10,000/year, while the average cost for a private university is $38,000 - $50,000/year. Worse, the average student in the U.S. graduates college with an amount of debt that exceeds $37,000.

So, costs are higher and debt is almost certain, but the payoff comes with the degree…right?

Well, after a wave of college students graduated last year they faced the soul-crushing reality that, after chasing the rainbow, there’s no pot of gold at the end of it

:

Everyone has different stats on the costs of college - it’s far from easy to pin down a specific number or an agreed on range for present costs - but here’s a shocking piece from The Wall Street Journal:

A college education is among the largest investments most Americans will make. The total cost of attending a public college is about $36,000 a year, and the average length of time to a degree is nearly five years. Tack on debt service for student loans and the opportunity cost of not working while in school, and the real cost of college can easily pass $300,000—more than the median net worth of most families.

- The Wall Street Journal, Why Americans Have Lost Faith in the Value of College

How could you reasonably justify such an expense?

The debt you stack with no guarantee of financial prosperity through your degree means that ~4 years of time (plus every year you have to work to pay off your debt) swirled down the drain right before your eyes.

And, now you or your kids will have to face the dark uncertainty of their future...

Anyone with half a brain could measure those factors and see that they come out to a net negative result. The only redeeming factor of college is the social aspect…and even that is questionable.

Put it to the test

The solution lies within The Preparation - a program developed my Doug Casey and my father to help young men to get a head start in life by learning skills, making money, building a vast network of friends, and living through a number of interesting experiences while also developing character.

I’ve been acting as a beta tester for this program for over a year now. After just one year within The Preparation I ended up with more money than I had when I started. Not only that, but I ended up with more friends, skills, and, hopefully, a better character.

As we have been putting together a book for the program we added a list of high value skills, where to learn them, and how much it would cost. Some skills include: piloting, welding, wilderness survival, EMT… So, we wanted to see just how much better or worse a person with a wide variety of skills will do in the world compared to someone with a Bachelors degree.

Especially with the acceleration of AI, it’s almost certain that most (if not all white collar jobs) will be overtaken by AI.

Anyway, we asked ChatGPT to measure the benefits of a Bachelors degree in Finance (one of the highest paying degree in recent years) and The Preparation. The results speak for themselves…

See here:

Comparative Analysis: The Preparation vs. Bachelor’s Degree in Finance

Given the transformative impact of AI, automation, and broader trends in technology, education, and work, the value of these two paths—The Preparation and a Finance degree—must be evaluated in the context of the likely future. Below is a detailed comparative analysis, incorporating these factors.

1. Skill Acquisition and Practicality

The Preparation:

Diverse and Hands-On Skills:

Practical, physical skills (e.g., piloting, welding, survival training) are highly resistant to automation and AI.

Certifications (e.g., EMT, heavy machinery operation, private pilot’s license) provide immediate earning potential.

Encourages mastery of self-reliance and adaptive problem-solving, which AI cannot replicate.

Portfolio of Capabilities:

A wide array of marketable skills enables flexibility across industries and entrepreneurial ventures.

Finance Degree:

Specialized Knowledge:

Provides expertise in financial modeling, corporate finance, investments, and risk management.

Prepares students for roles that currently demand formal credentials (e.g., banking, investment analysis).

Limited Practicality:

Most skills are theoretical and require years of experience to translate into real-world applicability.

Impact of AI and Trends:

The Preparation: Future-proof due to focus on non-automatable skills like physical labor, creative problem-solving, and leadership in uncertain environments.

Finance Degree: Faces risks as AI increasingly automates financial analysis, trading, and advisory functions, reducing demand for entry-level roles.

Winner: The Preparation, for versatility and alignment with skill-based hiring trends.

2. Career Readiness

The Preparation:

Entrepreneurial and Flexible:

Graduates can monetize skills in trades, aviation, or tourism and pursue entrepreneurial ventures.

Thrives in the gig economy and other decentralized work environments.

Risk of Unstructured Path:

Success depends on personal initiative and ability to create opportunities.

Finance Degree:

Structured Career Path:

Direct access to corporate finance, banking, and consulting roles through formal recruiting channels.

Declining Entry-Level Roles:

AI-driven automation threatens to shrink the availability of traditional finance jobs, especially entry-level positions.

Impact of AI and Trends:

The Preparation: Adaptable to gig-based, entrepreneurial, or hands-on career paths.

Finance Degree: At risk of oversupply of graduates for a declining pool of traditional jobs.

Winner: The Preparation, due to better alignment with evolving career landscapes.

3. Personal Development

The Preparation:

Transformative Growth:

Develops grit, resilience, and adaptability through immersive, challenging experiences (e.g., wilderness survival, farming, Muay Thai training).

Reflective practices encourage self-awareness, critical thinking, and emotional intelligence.

Global Perspective:

Experiences abroad (e.g., Thailand, Italy, Alaska) build cross-cultural understanding and adaptability.

Finance Degree:

Gradual Growth:

Intellectual development through structured coursework.

Limited real-world exposure unless supplemented by internships or extracurricular activities.

Impact of AI and Trends:

The Preparation: Prepares individuals to navigate a world requiring continuous adaptation and creativity.

Finance Degree: Slower development of resilience and self-reliance due to its academic focus.

Winner: The Preparation, for fostering rapid and holistic personal growth.

4. Financial Investment and ROI

The Preparation:

Cost: ~$40,000–$60,000 over four years.

ROI:

Skills are monetizable immediately after each cycle (e.g., welding, EMT work, piloting).

No long-term debt burden, enabling earlier financial independence.

Finance Degree:

Cost: ~$200,000–$300,000 over four years at a competitive university.

ROI:

High earning potential in established industries, but significant debt can delay financial independence.

Declining demand for traditional roles reduces ROI over time.

Impact of AI and Trends:

The Preparation: Lower upfront costs and quicker ROI in skills-based markets.

Finance Degree: Higher upfront costs with increasing risk of diminished long-term value.

Winner: The Preparation, for cost efficiency and quicker monetization of skills.

5. Employment Trends and Security

The Preparation:

Future-Proof Careers:

AI and automation are unlikely to replace hands-on roles (e.g., heavy equipment operators, pilots, tradespeople).

Skills support diverse career options, reducing dependency on any single industry.

Risk of Niche Focus:

Skills may require creative marketing to transition into broader industries.

Finance Degree:

Automation Risk:

Roles like financial analysis, data entry, and advisory are increasingly handled by AI, shrinking job markets.

Credential-Heavy Fields:

While some positions remain AI-resistant (e.g., strategic advising), these require significant experience and advanced degrees.

Impact of AI and Trends:

The Preparation: Better equipped for diverse, non-automatable roles.

Finance Degree: Relies on industries directly threatened by AI.

Winner: The Preparation, for better alignment with future-proof employment trends.

6. Networking Opportunities

The Preparation:

Unconventional Networks:

Builds relationships in diverse, real-world environments (e.g., global peers, industry experts in trades and crafts).

Self-Directed:

Networking is informal and depends on individual effort.

Finance Degree:

Structured Networks:

Access to alumni networks, career fairs, and corporate internships.

Risk of Oversaturation:

Increasing competition in traditional finance roles reduces the utility of networks.

Impact of AI and Trends:

The Preparation: Leverages unique, decentralized networks.

Finance Degree: Offers traditional but potentially oversaturated networks.

Winner: The Preparation, for adaptability and broader diversity of networks.

Final Verdict: Which is Better?

In Today’s Day and Age:

The Preparation is better for individuals seeking:

Versatile, future-proof skills that can adapt to changing markets.

Freedom from traditional structures and debt-heavy education.

Entrepreneurial or gig-based careers that emphasize hands-on expertise.

Bachelor’s in Finance is better for individuals pursuing:

Credential-dependent roles in structured fields (e.g., corporate finance, consulting).

Leadership positions in established industries—provided they supplement their degree with tech and AI expertise.

Stable career paths in industries resistant to automation.

Considering AI and Other Trends:

The Preparation thrives in a world where skills, adaptability, and independence are valued over formal credentials.

Finance Degrees face diminishing value as automation disrupts entry-level and mid-tier roles.

Winner: The Preparation emerges as the objectively better choice for the majority, especially in a future dominated by AI, automation, and evolving career landscapes.

So, with this analysis from ChatGPT, it’s clear that the accumulation of skills and economic opportunity stands on the side of The Preparation…even when matched up against one of the highest paying degree in recent years.

On one side you have more skills, more opportunity, a better character, and a wide variety of life experience. On the other you have a narrow range of possibilities and knowledge, fewer skills, almost no real life experience, less opportunity, and little to no character development.

So, I ask you…which would you choose for your child?

-Maxim Benjamin Smith

The average unemployed youth would not be able to afford this course either. Youth allowance or job seeker does not even cover living costs. Bring back Tafe and apprentiships for free while working.

The oddity of the title made me look twice to decide as to the target audience.

Personally, my hope for your audience to be greater in number for those who'd normally have been in Boy Scouts than a bunch of older guys.

Fondly remembered, best left unsaid.